how much federal taxes deducted from paycheck nc

Note Theres a maximum annual amount of Social Security tax that can be withheld per employee. However each state specifies its own tax rates which we will cover in more detail below.

Social Security Tax Due.

. Use tab to go to the next focusable element. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly. Tax system is a pay-as-you-go arrangement.

However NO deductions can be made from the full. Total Federal Income Tax Due. The employer withholds 7650 from this employees paycheck and sends it to the government.

For tax year 2021 all taxpayers pay a flat rate of 525. A in non-overtime workweeks wages may be reduced to the minimum wage level but cannot go below the minimum wage currently 725 an hour and b during overtime workweeks wages may be reduced to the minimum wage level for the first 40 hours. Plus to make things even breezier there are no local income taxes.

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS. The only other thing you need to worry about is North Carolina State Unemployment Insurance. Look at the tax brackets above to see the breakout Example 2.

Social Security Tax Due. Just like North Carolina has its unemployment tax so does the federal government. Federal Insurance Contributions Act tax FICA 2022.

If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. Income Tax Breakdown 2022 Tax Tables Tax Rate Threshold Tax Due in Band. Federal income tax rates range from 10 up to a top marginal rate of 37.

Median household income in 2020 was 67340. Therefore a taxpayer must determine federal adjusted gross income before beginning the North Carolina return. Its commonly called FUTA short for Federal Unemployment Tax Act.

For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475. Federal Income Tax Total from all Rates. North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Theres no salary limit for the Medicare tax. Taxes are limited to 85 of your Social Security benefits.

States dont impose their own income tax for tax year 2022. You are able to use our North Carolina State Tax Calculator to calculate your total tax costs in the tax year 202122. You pay 12 on the rest.

Federal Paycheck Quick Facts. Federal Income Tax Total from all Rates. The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Income Tax Breakdown 2022 Tax Tables Tax Rate Threshold Tax Due in Band. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. That means employees must pay their federal income tax liability throughout the year.

If your income is more than 34000 you may have to pay taxes on up to 85 of your benefits. Federal Insurance Contributions Act tax FICA 2022. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

This can make filing state taxes in the state relatively simple as even if your salary changes youll be paying the same rate. For example if you file as an individual and your combined income is between 25000 and 34000 you may have to pay income tax on up to 50 of your benefits. The individual income tax rate in North Carolina is 5499 percent for tax years 2017 and 2018 and it will be 5499 percent in 2019.

However 2019 brought an. If you had 50000 of taxable income youd pay 10 on. Social Security Maximum Tax.

The starting point for determining North Carolina taxable income is federal adjusted gross income. Total Federal Income Tax Due. Because this amount changes annually students should research the latest Social Security cap.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. To facilitate this pay-as-you-go. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

Actually you pay only 10 on the first 9950. Social Security Compensation Limit. If the taxpayer is not filing a federal income tax return the taxpayer must complete a schedule showing the computation of federal.

Our calculator has been specially developed in order to provide the users of the calculator with not. Deductions for the employers benefit are limited as follows. Social Security Compensation Limit.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Social Security Maximum Tax.

There is a flat income tax rate of 499 which means no matter who you are or how much you make this is the rate that will be deducted.

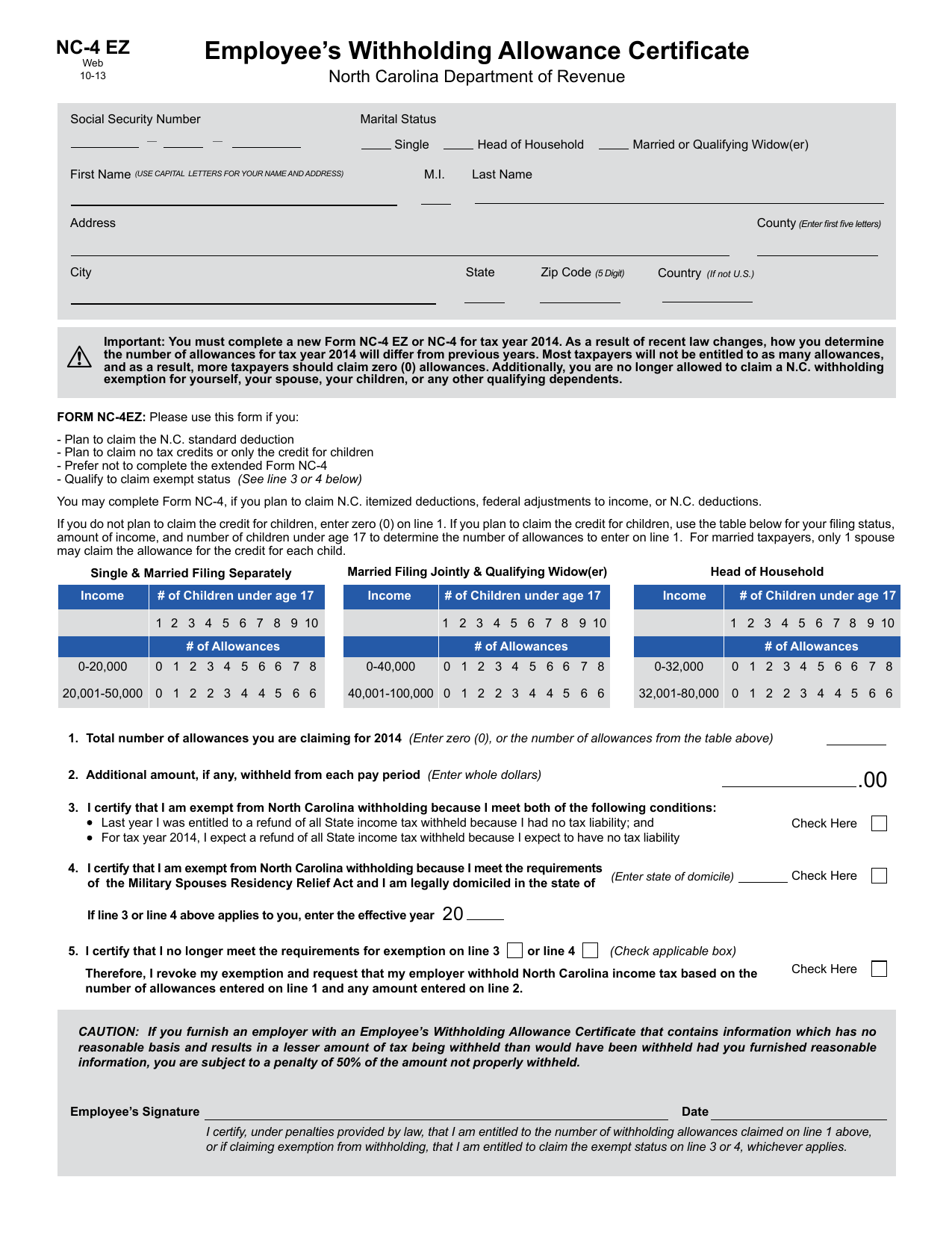

Employee S Withholding Allowance Certificate Nc 4 Ez

Here S How Rising Inflation May Affect Your 2021 Tax Bill

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

North Carolina Sales Tax Small Business Guide Truic

North Carolina Income Tax Calculator Smartasset

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Need A Wage Calculator Advertising Booking Form 2015 Here S A Free Template Create Ready To Use Forms At Formsbank C Advertising Booking Spreadsheet Template

Irs Form 1040 Stock Photo In 2022 Irs Forms Tax Refund Irs

Understanding Your Paycheck Http Www Hfcsd Org Webpages Tnassivera News Cfm Subpage 1077 Student Teaching Teaching Activities Understanding Yourself

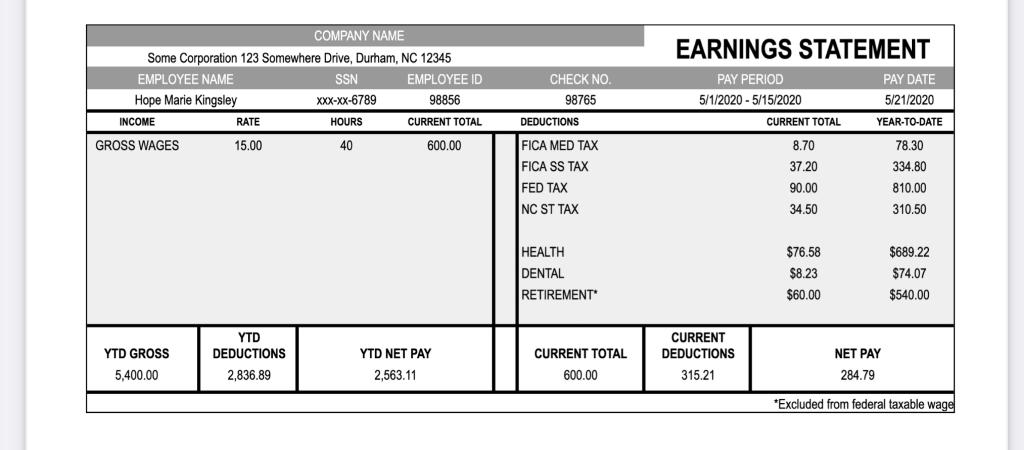

Solved Earnings Statement Company Name Some Corporation 123 Chegg Com

Documents Store Payroll Template Printable Tags Template Money Template

North Carolina Income Tax Calculator Smartasset

Asset Protection In North Carolina What Can You Do To Protect Your Assets From Your Creditors Creditors Estate Planning Asset

Calculating Gross Pay Worksheet Student Loan Repayment Financial Literacy Worksheets Budgeting Worksheets

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

See Which States Do Not Have Income Tax Sales Tax Or Taxes On Social Security Start Packing Income Tax Tax Sales Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

North Carolina Providing Broad Based Tax Relief Grant Thornton